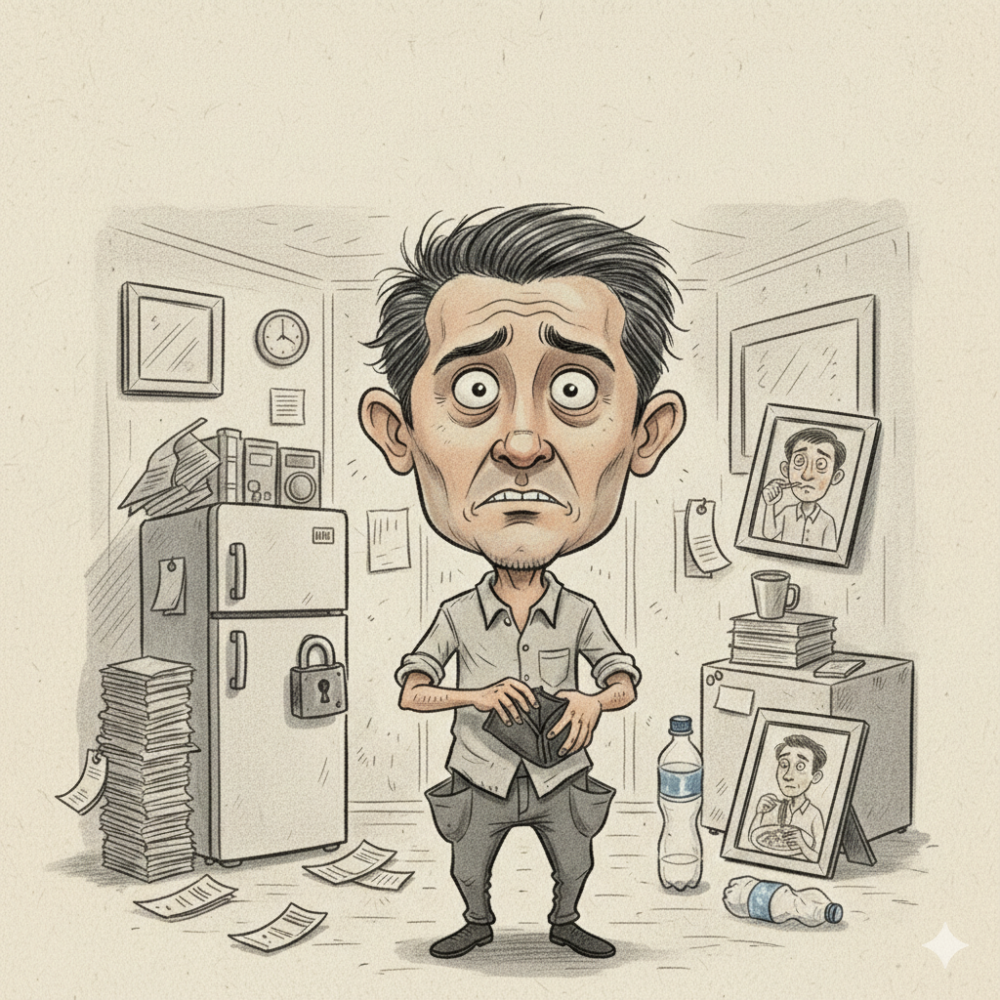

The Mystery of the Vanishing Paycheck

Modern paychecks have a peculiar habit. They arrive with promise and vanish with unsettling speed, often without any memorable splurge to explain their disappearance. This financial whodunit plays out quietly, month after month, leaving many earners baffled and mildly betrayed.

When Your Salary Disappears Faster Than Expected

The month begins with optimism. Bills are paid, essentials secured, and yet—somehow—the balance dwindles long before the calendar does. The erosion feels abrupt, almost rude, as if money evaporates in the background while attention is elsewhere.

The Common Assumption: “It Must Be Snacks and Coffee”

Snacks become the usual suspect. A pastry here, a latte there. These are visible, easy to blame, and emotionally satisfying targets. But they are rarely the true culprits. Focusing on them obscures a far more intricate financial ecosystem at work.

Looking Beyond Snacks: The Real Money Drains

To understand disappearing income, the lens must widen. The real drains are often subtle, systemic, and unglamorous.

Small Expenses That Don’t Feel Small Over Time

Minor, recurring charges possess a compounding power. Individually innocuous, collectively corrosive. Daily conveniences quietly metastasize into significant monthly outflows, siphoning funds without triggering alarm.

The Myth of “I Hardly Spend on Myself”

Spending is not always indulgent to count. Practical purchases, comfort-driven decisions, and socially expected expenses all qualify. The myth persists because these costs feel justified, even virtuous.

Fixed Costs: The Silent Salary Eaters

Fixed expenses operate with mechanical precision. They take their share regardless of mood, memory, or intention.

Rent, Utilities, and Bills That Leave No Wiggle Room

Housing consumes a disproportionate share of income in many cities. Add utilities, internet, insurance, and mobile plans, and flexibility evaporates. What remains must stretch uncomfortably far.

Subscriptions You Signed Up For and Forgot About

Subscriptions thrive on invisibility. They are quiet, automatic, and persistent. Over time, forgotten sign-ups accumulate into a steady financial leak.

Annual and Monthly Fees Hiding in Plain Sight

Membership dues, service fees, and maintenance charges often bypass scrutiny because they arrive infrequently. Their irregularity makes them easy to ignore—and easy to underestimate.

Lifestyle Creep: When Comfort Quietly Gets Expensive

As income stabilizes, expectations subtly inflate. Comfort replaces frugality without ceremony.

Gradual Upgrades That Don’t Feel Like Splurges

Better furniture. Faster devices. Slightly nicer clothes. None feel extravagant. Together, they redefine “normal” spending at a higher price point.

Convenience Costs: Paying More to Save Time

Time-saving services extract a premium. Pre-cut vegetables, express shipping, and on-demand services trade money for minutes, often without conscious calculation.

Transportation Costs That Add Up Quickly

Movement is expensive, even when it feels routine.

Fuel, Parking, and Maintenance Beyond the Commute

Cars demand constant tribute. Fuel, parking, repairs, and depreciation conspire to inflate costs far beyond the simple act of commuting.

Ride-Hailing and Delivery Apps as Daily Habits

What begins as occasional convenience becomes habitual reliance. Each small fare or delivery fee adds another line item to the ledger.

Food Spending That Isn’t “Snacks” but Still Counts

Food costs are often misclassified in the mind, neatly separated into “necessary” and “optional.”

Eating Out Without Calling It Eating Out

Prepared meals, takeout, and casual dining blur the line. They feel practical, not indulgent, and therefore escape scrutiny.

Workday Meals and Social Food Obligations

Lunches near the office, coffee meetings, and celebratory dinners accumulate quietly, driven by routine and social gravity.

Digital Spending in the Background

The digital economy excels at monetizing inertia.

Streaming, Cloud Storage, and App Subscriptions

Entertainment and productivity services promise value through abundance. The problem is not any single service, but the collective weight of many.

In-App Purchases and Auto-Renewals You Rarely Notice

Microtransactions and renewals exploit frictionless payment systems. They feel weightless. They are not.

Social and Family Expenses You Don’t Budget For

Human connection carries financial implications rarely penciled into spreadsheets.

Weddings, Birthdays, and “Just This Once” Contributions

Social obligations arrive unpredictably but persistently. Saying yes feels necessary. Saying no feels costly in other ways.

Helping Family Members Without Tracking the Cost

Support offered casually can become a recurring expense. Generosity, while noble, still affects cash flow.

The Psychological Traps Behind Fast-Spending Salaries

Money behavior is governed as much by cognition as by arithmetic.

Mental Accounting: Why Some Money Feels Free

Bonuses, refunds, and side income are often treated as expendable. The brain assigns them a different moral weight.

The “I Deserve This” Justification Loop

Reward-based spending rationalizes itself. After effort or stress, purchases feel earned—even when they strain finances.

Irregular Expenses That Break the Budget

The unexpected is rarely truly unexpected.

Medical, Repairs, and Emergencies That Aren’t Really Rare

These expenses recur with enough regularity to be predictable. Yet they are rarely planned for adequately.

Annual Expenses That Should Be Monthly in Your Mind

Taxes, insurance premiums, and holiday costs should be amortized mentally. When they aren’t, they feel catastrophic.

Why Tracking Feels Harder Than Spending

Spending is effortless. Tracking is not.

The Gap Between Perception and Reality

Memory edits spending history. It minimizes frequency and magnitude, creating a comforting but inaccurate narrative.

How Cashless Payments Blur Spending Awareness

Digital transactions lack the visceral sting of cash. The absence of physical exchange dulls financial sensitivity.

What Your Bank Statement Is Trying to Tell You

Bank statements are less judgmental than people think. They are simply honest.

Patterns That Only Appear Over a Full Month

Daily reviews miss context. Monthly overviews reveal habits, repetitions, and creeping trends.

Red Flags Hidden in Repetitive Transactions

Frequent small charges often matter more than rare large ones. Repetition is the signal.

The Role of Inflation and Rising Living Costs

Sometimes, the problem is not behavior but environment.

Paying More for the Same Lifestyle

Inflation quietly erodes purchasing power. Maintaining the same routine now costs more than it did last year.

Why Your Salary Feels Smaller Than It Used To

When wages lag behind costs, stagnation masquerades as mismanagement.

Income Timing vs. Expense Timing

Cash flow timing shapes perception.

Why the First Two Weeks Feel Comfortable

Expenses cluster later in the month. Early abundance creates a false sense of security.

The End-of-Month Financial Squeeze Explained

By the time fixed and variable costs converge, flexibility is gone. Stress follows predictably.

Budgeting Myths That Make Things Worse

Misconceptions discourage engagement.

“I Don’t Earn Enough to Budget”

Budgeting is most useful when margins are tight. Clarity matters more than surplus.

“Budgeting Means Cutting All Fun”

Effective budgeting reallocates, not eradicates. Pleasure survives. Waste does not.

Reframing the Question: It’s Not About Snacks

The narrative needs revision.

Understanding Where the Money Really Goes

Once spending is seen in full, blame shifts from trivial treats to structural patterns.

Shifting From Blame to Awareness

Awareness replaces guilt with agency. That alone changes behavior.

Small Changes That Create Breathing Room

Transformation rarely requires austerity.

Adjustments That Don’t Require Extreme Frugality

Minor renegotiations, cancellations, and habit tweaks yield disproportionate relief.

Making Invisible Expenses Visible

Visibility breeds accountability. What is seen can be managed.

Building Financial Awareness Without Obsession

Sustainability matters more than perfection.

Simple Tracking Habits That Actually Stick

Consistency beats complexity. Fewer categories, reviewed regularly, outperform elaborate systems.

Checking Progress Without Daily Stress

Periodic reflection keeps finances in view without becoming oppressive.

When Your Salary Is Normal but Your Costs Aren’t

Sometimes the math is external.

Comparing Income to Cost of Living Realistically

Context matters. A reasonable salary can feel insufficient in an unreasonable environment.

Knowing When the Issue Isn’t Personal Spending

Structural pressures deserve acknowledgment, not self-blame.

The Bigger Picture: Control, Not Deprivation

Financial health is not asceticism.

Spending With Intention Instead of Guilt

Intentional spending aligns money with values, not shame.

Turning “Where Did My Money Go?” Into “I Know Exactly”

Clarity transforms confusion into confidence. The paycheck stops vanishing—and starts behaving.