The Monthly Money Stress Everyone Knows Too Well

Money anxiety has a peculiar way of showing up right when the calendar flips past the middle of the month. Bills loom. Balances shrink. The gap between income and expenses suddenly feels cavernous. This stress is remarkably universal, cutting across income levels and professions, and it often has less to do with how much is earned and more to do with how money is managed.

Why So Many Paychecks Disappear Before the Month Ends

For many households, a paycheck arrives with a sense of relief—and vanishes with alarming speed. The culprit is rarely a single large expense. Instead, it’s the cumulative effect of obligations stacked too close together: rent, utilities, subscriptions, debt payments, groceries, and daily conveniences. When spending is reactive rather than intentional, money quietly evaporates long before the next payday appears.

The Hidden Habits That Quietly Drain Your Bank Account

Financial erosion often hides in plain sight. Frequent takeout meals, impulsive online purchases, unused memberships, and “just this once” spending patterns compound over time. These habits don’t feel extravagant in isolation, yet collectively they create a steady drain that undermines financial stability month after month.

Getting Clear on Where Your Money Actually Goes

Clarity is the antidote to financial confusion. Without a clear view of cash flow, it’s impossible to make informed decisions or meaningful changes.

Tracking Spending Without Obsessing Over Every Dollar

Effective tracking is about awareness, not micromanagement. Reviewing bank statements weekly or categorizing expenses at a high level can reveal patterns without becoming tedious. The goal is to observe tendencies, not to scrutinize every coffee purchase with suspicion.

Fixed Expenses vs. Flexible Spending: Knowing the Difference

Fixed expenses—rent, insurance, loan payments—form the non-negotiable backbone of a budget. Flexible spending, on the other hand, includes categories like dining, entertainment, and shopping. Understanding this distinction makes it easier to know where adjustments are possible when money feels tight.

Identifying Financial “Leaks” You’ve Been Ignoring

Financial leaks are recurring expenses that deliver little value. They persist because they’re familiar, automated, or simply forgotten. Identifying them requires intentional review, but sealing even a few can free up surprising amounts of cash.

Building a Budget That Doesn’t Feel Like Punishment

Budgets often fail because they’re designed as instruments of restriction rather than tools for alignment.

Why Traditional Budgets Fail Most People

Rigid budgets collapse under real life. Unexpected expenses, social obligations, and emotional spending derail plans built on perfection. When budgets leave no room for flexibility, they’re quickly abandoned.

Creating a Realistic Monthly Spending Plan

A functional budget reflects actual behavior, not aspirational ideals. It accommodates variable expenses and acknowledges personal priorities. Realism is what makes consistency possible.

The 50/30/20 Rule—and When to Break It

The 50/30/20 framework offers a helpful baseline, but it isn’t universal. High housing costs, debt repayment goals, or fluctuating income may require deviations. Flexibility matters more than adherence.

Budgeting for Real Life, Not an Ideal Month

Some months are expensive. Others are unpredictable. Planning for imperfection—rather than ignoring it—creates resilience and prevents discouragement when things don’t go as planned.

Making Your Income Work Harder for You

How income is managed can be just as important as how much comes in.

Timing Your Bills Around Paydays

Aligning due dates with paydays reduces cash flow strain and minimizes the risk of overdrafts or late fees. Many creditors allow date adjustments upon request.

Separating Spending Money from Essentials

Using separate accounts for fixed expenses and discretionary spending introduces clarity and control. When spending money runs low, it sends an immediate signal to slow down.

Automating What You Can to Avoid Mistakes

Automation removes friction. Automatic bill payments and transfers to savings reduce reliance on memory and willpower, two notoriously unreliable resources.

Smarter Ways to Handle Everyday Expenses

Daily expenses wield disproportionate influence over monthly outcomes.

Groceries Without the Guesswork

Meal planning, shopping with lists, and avoiding impulse buys can dramatically reduce food spending. Consistency, not extreme frugality, produces the best results.

Cutting Utility Bills Without Sacrificing Comfort

Small adjustments—LED lighting, mindful thermostat use, unplugging idle electronics—can trim utility costs without diminishing quality of life.

Transportation Costs That Quietly Add Up

Fuel, maintenance, parking, and insurance accumulate quickly. Evaluating transportation choices and consolidating trips can yield meaningful savings.

Managing Subscriptions and Recurring Charges

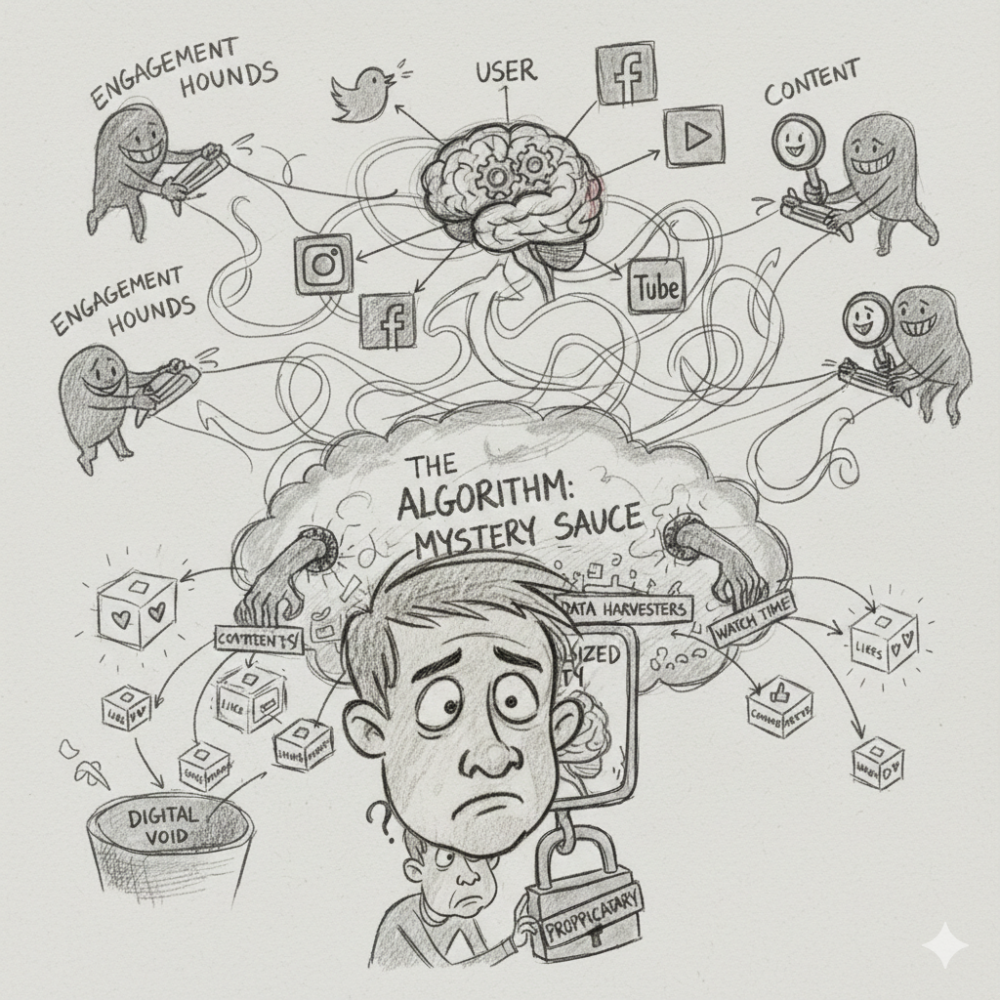

Recurring expenses thrive on inattention.

The Subscription Creep Problem

Streaming services, apps, and memberships accumulate gradually. Each addition feels minor until the aggregate total becomes burdensome.

How to Audit Monthly Charges in Under an Hour

A simple review of bank and credit card statements can uncover forgotten subscriptions. Categorizing them reveals which ones truly earn their keep.

Deciding What to Cancel, Keep, or Downgrade

The question isn’t whether something is affordable, but whether it’s valuable. Downgrading plans or canceling underused services restores financial breathing room.

Preparing for Expenses That Aren’t Really “Unexpected”

Many so-called surprises are predictable with hindsight.

Annual and Irregular Costs You Should Plan For

Insurance premiums, holidays, vehicle maintenance, and medical expenses recur with stubborn regularity. Planning for them transforms shocks into inconveniences.

Creating Sinking Funds That Prevent Panic

Sinking funds allocate small amounts monthly toward future expenses. They diffuse financial stress by spreading costs over time.

Handling Emergencies Without Derailing Your Month

True emergencies require liquidity. A modest emergency fund can prevent reliance on high-interest debt during crises.

Using Cash and Cards More Intentionally

Payment methods influence behavior more than most realize.

When Cash Still Makes Sense

Cash creates immediacy and friction, which can curb overspending in discretionary categories.

Credit Cards as Tools, Not Traps

Used strategically, credit cards offer rewards and protection. Misused, they amplify financial strain. Paying balances in full preserves their utility.

Avoiding the Minimum Payment Mindset

Minimum payments prolong debt and inflate costs. Prioritizing principal reduction accelerates progress and restores cash flow.

Saving Without Feeling Like You’re Falling Behind

Saving doesn’t require abundance. It requires intention.

Starting Small When Money Feels Tight

Even modest contributions build momentum. Consistency matters more than magnitude.

Treating Savings Like a Monthly Bill

When savings are automated and non-negotiable, they become a habit rather than an afterthought.

Building an Emergency Fund That Actually Works

An effective emergency fund reflects real expenses, not abstract targets. It’s practical, accessible, and replenished after use.

Adjusting Your Lifestyle Without Feeling Deprived

Sustainable change respects enjoyment.

Mindful Spending vs. Cutting Everything Fun

Mindful spending prioritizes satisfaction over quantity. It allows enjoyment without excess.

Choosing What’s Worth Paying For

Spending aligns best with values. Identifying what genuinely enhances life clarifies where money should go.

Redefining “Affordable” for Your Reality

Affordability isn’t just about price. It’s about impact on long-term stability and peace of mind.

Staying Consistent When Motivation Fades

Discipline outlasts enthusiasm.

Monthly Money Check-Ins That Take 15 Minutes

Brief, regular reviews maintain awareness without becoming burdensome.

Spotting Trouble Early and Course-Correcting

Early detection of overspending prevents small issues from becoming systemic problems.

Learning From Bad Months Instead of Feeling Guilty

Setbacks are data, not failures. Reflection replaces shame with strategy.

Tools and Systems That Make Money Easier to Manage

The right tools reduce cognitive load.

Budgeting Apps vs. Simple Spreadsheets

Both can work. The best choice is the one used consistently.

Bank Features That Help You Stay on Track

Sub-accounts, spending insights, and automatic transfers provide built-in structure.

Setting Alerts That Prevent Overspending

Balance and transaction alerts offer real-time feedback, curbing excess before it escalates.

When Your Budget Still Doesn’t Work

Sometimes the math simply doesn’t add up.

Signs You May Need to Increase Your Income

Persistent shortfalls, reliance on credit, and inability to save signal an income gap.

Side Hustles That Actually Fit Busy Schedules

Flexible, skill-aligned side income can supplement earnings without overwhelming time commitments.

Knowing When to Ask for Professional Help

Financial advisors and credit counselors provide perspective and structure during complex situations.

Creating a Financial Buffer That Brings Peace of Mind

Stability isn’t about wealth. It’s about margin.

What “Enough” Really Looks Like Month to Month

Enough means bills paid, savings growing, and stress diminishing.

Measuring Progress Beyond Your Bank Balance

Improved habits, reduced anxiety, and increased control signal real progress.

Building Confidence With Money Over Time

Confidence emerges from repetition, not perfection.

Turning Better Money Habits Into a Long-Term Routine

Lasting change is incremental.

Making Financial Management a Normal Part of Life

When money management becomes routine, it loses its emotional charge.

Teaching Yourself to Think One Month Ahead

Anticipation replaces reaction, shifting finances from chaotic to deliberate.

Ending the Cycle of Running Out of Money for Good

With clarity, structure, and consistency, the monthly money crisis becomes a relic of the past.