The Silent Drain: Why Our “Normal” Financial Habits are Costing Us a Fortune

Financial erosion rarely occurs with a bang; it is a rhythmic, quiet seepage. Most individuals navigate their economic lives by adhering to a set of unwritten rules deemed “normal” by the collective. However, this communal standard is often a blueprint for stagnation. By examining the mundane choices we make every day, we can uncover the systemic leaks that prevent true wealth accumulation.

The Psychology of the Status Quo: Why We Mirror Bad Money Moves

Human beings are inherently mimetic creatures. We find profound psychological safety in the herd, even when the herd is marching toward a cliff of insolvency. This “status quo bias” acts as a cognitive anchor, making us feel that as long as our neighbors are struggling with the same bills, we must be doing something right. It is a comforting delusion. We prioritize social cohesion over fiscal autonomy, often ignoring the mathematical reality of our bank statements to maintain a facade of cultural belonging.

The Danger of “Everyone Else is Doing It”

The ubiquity of a behavior is no testimonial to its efficacy. When we observe a society fueled by high-interest consumer debt and negligible savings rates, “normal” becomes a dangerous metric. Adopting the financial temperament of the masses leads to the same destination: a life of paycheck-to-paycheck fragility. To escape this gravity, one must cultivate a healthy level of skepticism toward popular economic milestones and peer-influenced spending.

Sneaky Subs: The Recurring Revenue Trap We’ve Accepted as Life

We have transitioned into a “subscription economy,” where ownership is replaced by perpetual access. This model leverages inertia. Once a service is integrated into our digital ecosystem, the friction of cancellation often outweighs the perceived cost of the monthly fee. It is a strategy of a thousand small cuts, designed to bleed a budget without triggering the alarm bells of a major purchase.

The $15 Blind Spot: How Small Monthly Charges Delete Your Savings

Micro-transactions are the termites of a modern budget. A streaming service here, a cloud storage fee there, and a premium app subscription elsewhere may seem inconsequential in isolation. Yet, through the lens of opportunity cost, these $15 leaks represent a massive “blind spot.” Over a decade, that unmonitored capital—if diverted into a compounding index fund—could have matured into a significant five-figure sum. We are essentially trading our future freedom for the convenience of temporary entertainment.

The “Cancel Culture” You Actually Need for Your Bank Account

It is time to be ruthless with your recurring outlays. A quarterly audit of your transaction history is a vital hygiene practice. If a service does not provide a tangible utility or profound joy, it must be excised. Adopting a personalized “cancel culture” ensures that your capital remains under your direct command rather than being syphoned off by corporations banking on your forgetfulness.

The Modern Mirage of Credit Card Rewards

Credit card companies are master psychologists. They offer “points” and “cash back” as a sophisticated bait, designed to gamify the act of spending. While a disciplined few may reap some benefits, the vast majority of consumers fall prey to the mirage. The system is predicated on the fact that people spend significantly more when using plastic than they do when using physical currency or direct debit.

Plastic Chasing Points: When Spending More to “Earn” More Fails

There is a profound irony in spending $1,000 on unnecessary items simply to “earn” $30 in rewards. This is a mathematical failure masquerading as a savvy hack. The psychological lure of the reward often bypasses the rational filter of the brain, leading to “point-chasing” behavior that inflates monthly expenses. If you are paying even a cent of interest, your rewards are not a gift—they are a high-interest loan you’ve given yourself.

The Myth of the Responsible Balance-Carrier

Many people believe that carrying a small balance on their credit card improves their credit score. This is an expensive fallacy. Keeping a balance serves only the lender’s interest by generating profit through usury. True financial sophistication involves utilizing credit for its convenience and security while ensuring the balance is decimated every single month.

Lifestyle Inflation: The Invisible Paycut

As our income ascends, our expectations often climb at a steeper trajectory. This phenomenon, known as lifestyle creep, ensures that despite earning more, we never actually feel wealthier. It is the invisible paycut we give ourselves. We move into larger homes, lease faster cars, and dine at more expensive tables, effectively neutralizing every career advancement we achieve.

Why Your Raise Disappeared Before It Hit Your Pocket

The moment a salary increase is announced, the mental gears of consumption begin to turn. We “pre-spend” the surplus on upgrades before the new funds ever reach the account. To combat this, one must decouple professional success from material consumption. Until you decide to keep your cost of living static while your income rises, you are simply running faster on a gilded treadmill.

The Luxury Creep: Turning “Wants” into “Needs” Overnight

Yesterday’s luxuries quickly become today’s necessities. The artisan coffee, the premium gym membership, and the high-end skincare routine are integrated into our baseline of existence. We lose the ability to distinguish between what we require to survive and what we desire for status. This shift makes it psychologically painful to “downgrade” even when a financial crisis necessitates it.

The Normalization of Perpetual Debt

Debt has been rebranded as “leverage” and “financing,” stripping it of its inherent danger. We live in an era where being debt-free is considered an anomaly rather than an aspiration. By normalizing the carrying of liabilities, we have surrendered our most powerful wealth-building tool: our income.

Financing the Mundane: From Toasters to T-Shirts

“Buy Now, Pay Later” (BNPL) schemes have democratized debt to an absurd degree. Financing small, consumable goods is a sign of extreme fiscal fragility. When we begin to break down the cost of a $50 shirt into four “easy” payments, we are no longer managing money; we are managing a collapse. This granular debt fragments our focus and makes it impossible to see the total weight of our obligations.

Why a Permanent Car Payment is a Wealth-Killer

The car payment is perhaps the most destructive “normal” habit in the modern world. Many treat a monthly vehicle bill as an unavoidable utility, like electricity or water. By constantly trading in vehicles for newer models, consumers ensure they are always paying interest on a rapidly depreciating asset. Breaking this cycle is the fastest way to inject thousands of dollars back into your net worth.

The “Treat Yourself” Trap and the Dopamine Deficit

In a high-stress society, spending has become a primary coping mechanism. The phrase “treat yourself” is often used as a linguistic shield to justify impulsive purchases. We are not buying products; we are buying a temporary hit of dopamine to alleviate the boredom or anxiety of a relentless work week.

Emotional Spending Masquerading as Self-Care

True self-care involves building a life you don’t need to escape from. Buying a designer handbag or a new gadget provides a fleeting euphoria that evaporates by the time the credit card statement arrives. When we conflate consumption with emotional healing, we create a feedback loop where financial stress leads to more spending, which in turn breeds more stress.

Breaking the Cycle of Retail Therapy Burnout

To stop the drain, we must find non-monetary ways to regulate our emotions. Whether it is nature, meditation, or creative pursuits, these “low-cost, high-value” activities provide lasting satisfaction without the lingering debt. Recognition of the emotional trigger is the first step toward breaking the retail therapy cycle.

The Great Savings Procrastination

Many people treat savings as the “leftovers”—whatever is remaining at the end of the month. Predictably, there is rarely anything left. We tell ourselves we will save more when we reach a certain age, get a specific promotion, or move to a cheaper city. This is the great procrastination that steals the power of time.

Waiting for the “Right Time” to Invest

Market volatility often paralyzes the uninitiated. They wait for a “dip” or a “sure thing,” remaining on the sidelines while inflation erodes their purchasing power. There is no “perfect” time to enter the market; there is only “time in the market.” Waiting for certainty is a strategy that guarantees mediocre results.

The High Cost of Staying in Cash Out of Fear

While a cash reserve is necessary, hoarding excessive liquidity is a slow-motion disaster. In an inflationary environment, cash is a melting ice cube. The fear of a market crash often prevents people from participating in the greatest wealth-creation machine in history. Risk is not just the possibility of loss; it is also the certainty of missing out on growth.

Home Ownership Myths That Drain the Wallet

The cultural narrative suggests that a home is always the best investment. However, a primary residence is often more of a liability than an asset during the years you live in it. It demands taxes, insurance, and constant maintenance—none of which provide a direct cash return.

Why Your Primary Residence Isn’t Always the Investment You Think

While real estate can appreciate, the “all-in” cost of ownership often rivals or exceeds that appreciation when adjusted for inflation and interest. Treating your home as a piggy bank can lead to “house poor” syndrome, where your net worth is locked in bricks and mortar, leaving you with no liquid capital for other opportunities.

The Maintenance Hole: Underestimating the True Cost of “The Dream”

The sticker price of a home is merely the “cover charge.” The true cost of ownership includes the roof that leaks, the HVAC system that fails, and the endless desire for aesthetic renovations. Without a dedicated sinking fund for these inevitabilities, the “dream home” becomes a nightmare for the monthly budget.

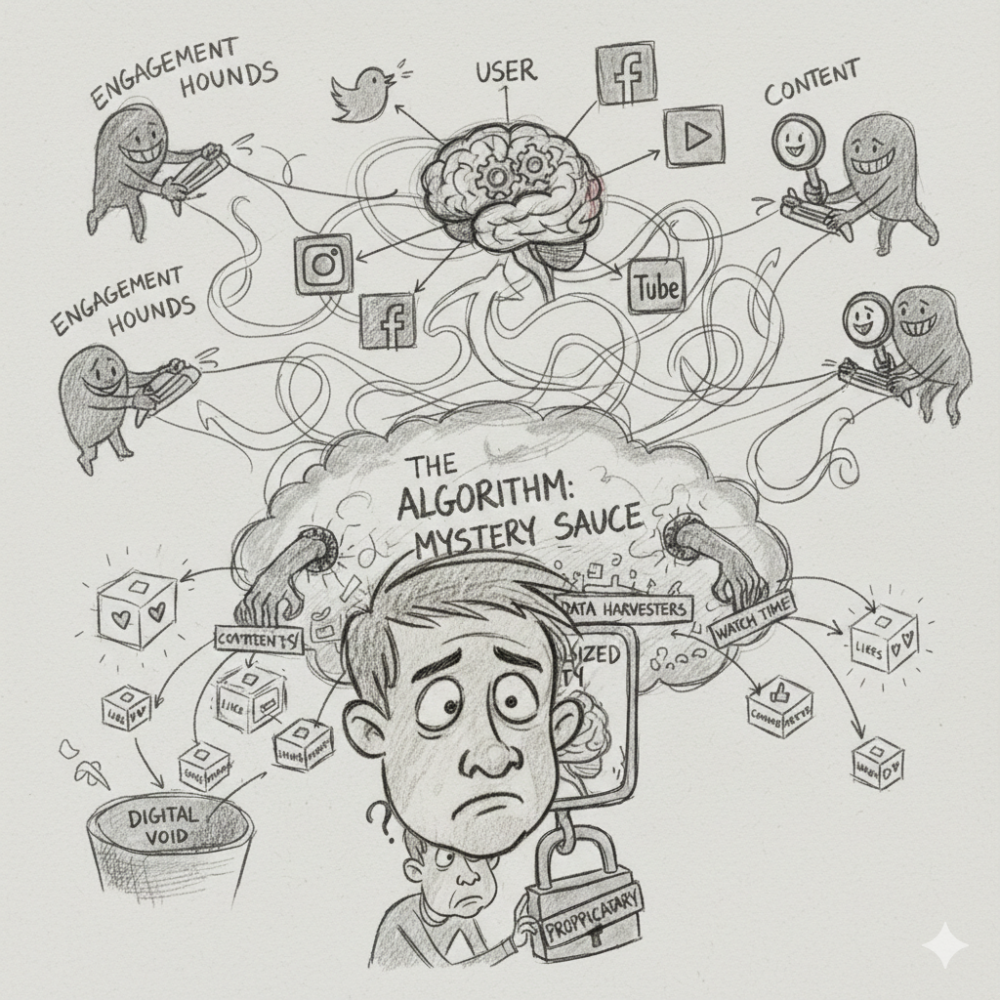

The Social Media Comparison Tax

Social media has turned life into a curated competition. We are no longer comparing ourselves to our neighbors, but to the top 0.1% of the world. This creates a “comparison tax”—the extra money we spend to maintain a digital persona that matches the highlights of others.

Curating a Life You Can’t Afford for People You Don’t Know

The desire for external validation is a bottomless pit. We purchase experiences and items not for their intrinsic value, but for their “post-ability.” When our spending is driven by the gaze of others, we lose ownership of our own financial priorities.

How “Doomscrolling” Leads to “Doomspending”

The algorithmic nature of social media ensures that we are constantly bombarded with targeted advertisements disguised as lifestyle content. Spending hours scrolling leads to a state of perceived lack, which we attempt to fill by clicking “Buy Now.” It is a frictionless path from digital envy to financial depletion.

The Safety Net Fallacy

A profound misunderstanding of risk leads many to believe they are more secure than they actually are. Relying on “potential” future income or the stability of a single employer is a precarious way to live.

Relying on Credit as an Emergency Fund

Using a credit card as a safety net is like using a parachute made of lead. In a true emergency—such as job loss—high-interest debt only compounds the crisis. Credit should be a tool for convenience, never a substitute for actual capital.

Why a Liquid “Oops” Fund is Non-Negotiable

Financial peace is found in the “Oops” fund—a dedicated, liquid account for the unexpected. Whether it’s a car repair or a medical bill, having the cash on hand turns a potential catastrophe into a mere inconvenience. It provides the psychological “margin” necessary to make rational decisions under pressure.

Redefining Financial Normality for a Wealthier Future

To achieve different results, you must be willing to look “weird” to the average person. Redefining what is normal in your own life requires a pivot from consumption to production, and from debt to equity.

Auditing Your Circle: Finding New Financial Role Models

You are the average of the five people you spend the most time with. If your social circle views debt as a tool for luxury, you likely will too. Seek out mentors and peers who value transparency, frugality, and long-term building. Surrounding yourself with those who prioritize net worth over “network” will naturally recalibrate your spending habits.

The First Step Toward Conscious Capital Management

The journey away from “normal” begins with awareness. By shining a light on these silent drains, you regain the power to direct your resources toward a life of genuine freedom. It is not about deprivation; it is about the intentional allocation of your life’s energy.